School Choice > Wisconsin

Wisconsin School Choice Programs

Wisconsinites enjoy access to a robust selection of School Choice programs, from public school open enrollment to vouchers for private school. If you’re looking to learn more about Wisconsin School Choice vouchers, we’ve put together a short guide to get you started.

Earn money with each latté, tank of gas, or grocery run. RaiseRight is the easiest fundraising program you can run to benefit your members, families, and communities.

Generate up to 5x more earnings—just by shopping with gift cards. No selling goods, planning events, or knocking on doors.

Wisconsin School Choice options

Even if you’d prefer to educate your child in the private sector, you may still be entitled to public funding to offset the cost of tuition. Qualified families can utilize Wisconsin’s Parental Choice Program (available at both regional and statewide levels) to access publicly funded vouchers for private education institutions.

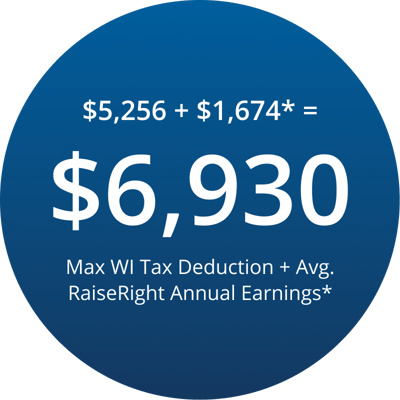

Wisconsin also offers an income tax deduction without income limits for families paying private school tuition for their children. Eligible families can apply for an individual tax deduction following K–12 private school tuition payments. With over 400 active Choice schools, odds are you’ll be able to find a perfect fit for your child.

Comparing all Wisconsin School Choice offerings

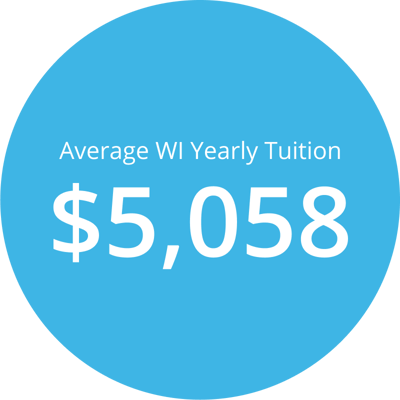

| Program Name | Type | Average Award | Eligible Expenses | Average Yearly Tuition |

|---|---|---|---|---|

| Special Needs Scholarship Program | Voucher | $12,883 | Tuition for children with special needs | $5,058 |

| K–12 Private School Tuition Deduction | Tax Credit/Deduction | $5,256 | Tuition | $5,058 |

| Parental Choice Program (Statewide) | Voucher | $10,443 | Tuition | $5,058 |

| Parental Private School Choice Program (Racine) | Voucher | $10,549 | Tuition | $5,058 |

| Milwaukee Parental Choice Program | Voucher | $10,460 | Tuition | $5,058 |

Parental Choice Voucher Program

Wisconsin’s statewide Parental Choice Program is a great option for low-income families looking for alternate

educational options. Families can gain greater access to private, accredited schools, as choice programs in

Wisconsin frequently cover a student’s entire annual tuition cost.

To qualify, students must

- Have an annual household income of 300% or less of the Federal Poverty Level (FPL)

- Meet State residency requirements

- Submit an annual application to the Choice program

From kindergarten through eighth grade, private schools in Wisconsin are not permitted to charge Choice students tuition. That means that your Parental Choice voucher will cover your child’s entire tuition until they reach high school. From ninth grade onward, institutions may charge additional tuition to Choice families whose annual household income exceeds 220% of the FPL.

Keep in mind that all schools (elementary, middle, and high schools) can charge additional learning and activity fees that are not covered by the voucher. These costs include things like uniforms, room and board, books, transportation fees, sports fees, or musical instruments.

Fundraising through RaiseRight is a great way to cover additional education costs—and many private schools in Wisconsin are already using RaiseRight. If you’d like to start your own RaiseRight tuition reduction program, learn more here.

When selecting students from their pool of Choice applicants, private institutions in Wisconsin are not permitted to make decisions based on the prospective student’s race, religion, prior test scores, or grades. They also can’t consider any recommendations and/or membership status of any organization (such as a parish or church) as a metric for acceptance. Religious educational institutions cannot compel Choice students to participate in religious activities once admitted.

Save more on your child’s education with RaiseRight

Families earning with RaiseRight know it’s the easiest, most effective way to offset private school costs. While Wisconsin's programs can help, they only cover tuition. By maximizing your RaiseRight earnings, you could save over $1,000 a year to offset additional school costs and reduce financial strain.

*Based on average spend for a household family of 4