School Choice > Indiana

Indiana School Choice Programs

In addition to open enrollment, magnet schools, charter schools, and homeschooling options, Indiana has two dedicated School Choice programs that allow taxpayers to access public education tax dollars to fund private education. Check out our introductory guide to Indiana’s Choice Scholarship Program and School Scholarship Tax Credit below.

Earn money with each latté, tank of gas, or grocery run. RaiseRight is the easiest fundraising program you can run to benefit your members, families, and communities.

Generate up to 5x more earnings—just by shopping with gift cards. No selling goods, planning events, or knocking on doors.

Indiana options for private institutions

If you’ve already determined that a private institution is the best fit for your child, you may be looking for ways to offset the cost of tuition. Here’s a starter guide to Indiana’s two essential School Choice programs for private schooling so that you can feel confident moving forward.

Option #1

Choice Scholarship Program (CSP)

Vouchers awarded through the Indiana Choice Scholarship Program average around $5,800 per academic year. But you’ll want to narrow down your potential school options first, as the participating school submits applications for CSP on behalf of the Choice student.

Option #2

School Scholarship Tax Credit (SSTC)

Scholarship Granting Organizations (SGOs) are alive and well in Indiana thanks to the School Scholarship Tax Credit program. People who donate to SGOs can receive tax credits up to 50% of their donation value, and students (and their families) can apply for the scholarships themselves.

Comparing all Indiana School Choice offerings

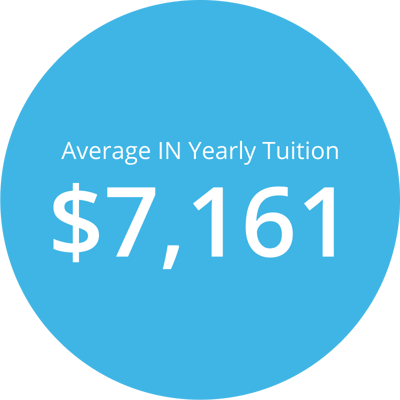

| Program Name | Type | Average Award | Eligible Expenses | Average Yearly Tuition |

|---|---|---|---|---|

| Education Scholarship Account Program (Special Needs) | Education Savings Account (ESA) | $6,203 | Tuition, educational therapies, individual classes, special needs services, testing fees, transportation, etc. | $7,161 |

| Private School/Homeschool Deduction | Tax Credit/Deduction | $1,835 | Private schooling, homeschooling expenditures | $7,161 |

| Choice Scholarship Program | Voucher | $6,264 | Tuition | $7,161 |

| School Scholarship Tax Credit | Tax-Credit Scholarship | $2,054 | Tuition | $7,161 |

Choice Scholarship Program (CSP)

Qualifying families in the state of Indiana can only apply for the Choice Scholarship Program in partnership with a private educational institution. If approved, students are granted the lesser of two funding options: 90% of their allocated public schooling tax funds or an amount equal to the tuition + relevant fees reported on the application submitted by the student’s Choice school.

To qualify, students must

- Be between the ages of 5 and 22 by October 1st of the relevant school year

- Have legal settlement in the state of Indiana

- Be listed as a dependant in a household with an annual income that doesn’t exceed 400% of the Federal Poverty Level (FPL)—in cases of split custody, the child’s primary residence must meet this requirement

Families who wish to apply for a CSP voucher must consult with the private institution they plan to enroll their child in—Indiana’s Choice Scholarship program only accepts applications through educational institutions. Take a look at the Indiana Department of Education’s list of participating private schools to explore institutions near you.

It’s important to note that Choice students are typically not permitted to transfer between institutions—each voucher granted is specific to both the child and the private institution where they’re enrolled. Students may successfully apply for a separate, second-semester scholarship and transfer between semesters if the voucher is approved. Second-semester scholarships award half the amount the student would receive if applying before the start of the school year.

Indiana’s Choice Scholarship Program offers long enrollment periods to allow parents ample opportunity to make arrangements. In the 2023-2024 school year, for example, families could apply:

- Between March 1st, 2023 and September 1st, 2023 (full year voucher)

- Between November 1st, 2023 and January 1st, 2024 (second-semester voucher)

Ultimately, the CSP is a fairly accessible School Choice option as far as qualifications go, but it can be a bit more difficult to navigate than comparable programs due to the school-submitted application process. However, with plenty of online resources, a long list of participating schools, and months-long application windows to balance the program, you and your child have a good chance of acquiring a publicly-funded scholarship through CSP.

School Scholarship Tax Credit (SSTC)

There are multiple benefits to Indiana’s School Scholarship Tax Credit system. First, taxpayers can enjoy up to a 50% return on donations to designated Scholarship Granting Organizations—a win for everyone.

Second, interested families can apply for scholarships associated with the program according to the private educational institution their child would like to attend. See the Indiana Department of Education’s list of SGO Participating Schools (including the Scholarship Granting Organizations they’re partnered with) to discover hundreds of options.

You can learn more about Indiana’s School Scholarship Tax Credit here.

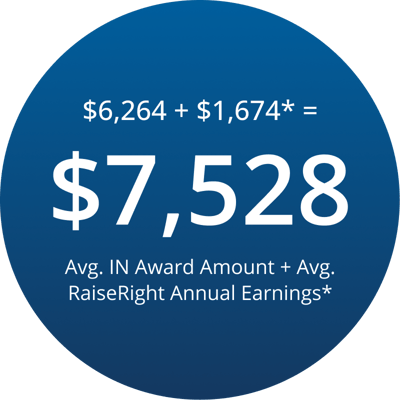

Save more on your child’s education with RaiseRight

Families earning with RaiseRight know it’s the easiest, most effective way to offset private school costs. While Indiana's vouchers can help, they don't completely cover the average tuition fees. By maximizing your RaiseRight earnings, you could save over $1,000 a year to offset school costs and reduce financial strain.

*Based on average spend for a household family of 4