School Choice > Arizona

Arizona School Choice Programs

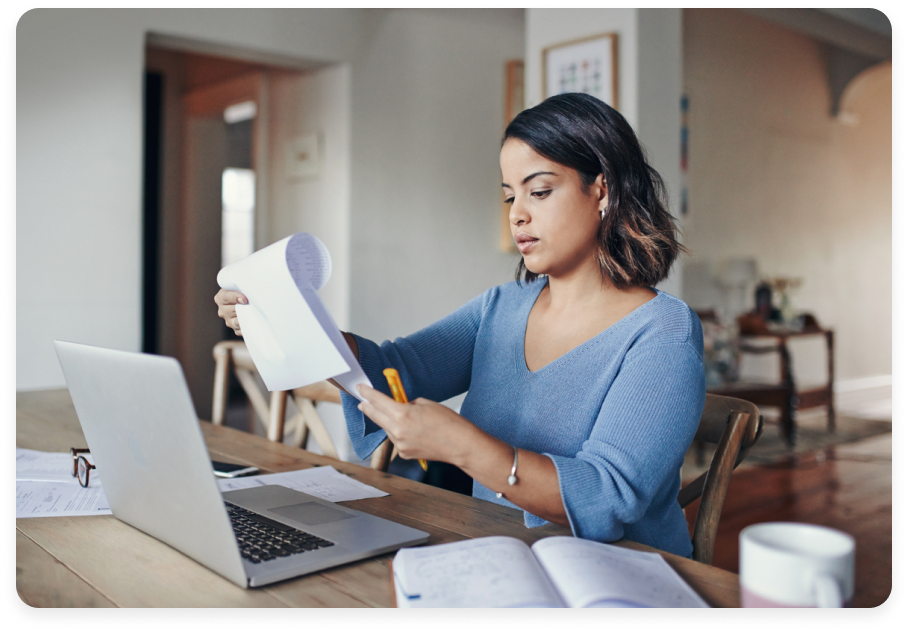

In addition to robust public school choice, magnet school, charter school, and homeschooling options, Arizona offers two private school choice programs.Learn how to channel your child’s portion of public funding to private education that suits your family’s needs—this short guide is the perfect way to

get started.

Earn money with each latté, tank of gas, or grocery run. RaiseRight is the easiest fundraising program you can run to benefit your members, families, and communities.

Generate up to 5x more earnings—just by shopping with gift cards. No selling goods, planning events, or knocking on doors.

Navigate Arizona’s private schools choice programs

As an Arizona resident, you can explore different avenues to support your child's private school expenses. Consider applying for these key programs and benefits.

Option #1

Empowerment Scholarship Accounts

This program is a fantastic resource for any family with school-aged children, regardless of economic status. All kids in grades 1-12 with proof of residency in the state qualify. Plus, spending guidelines for the program are unique, unrestrictive, and adaptable.

Option #2

Tax-Credit Scholarships

Arizona is home to four Tax-Credit Scholarship programs which use public funding to establish scholarships at participating private schools/Certified School Tuition Organizations (STOs).

Comparing all Arizona School Choice offerings

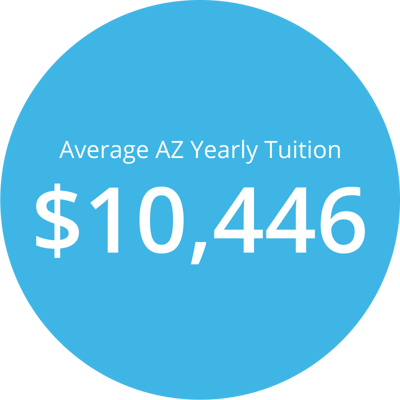

| Program Name | Type | Average Award | Eligible Expenses | Average Yearly Tuition |

|---|---|---|---|---|

| "Switcher" Individual Income Tax Credit Scholarship Program | Tax-Credit Scholarship | $1,710 | Tuition | $10,446 |

| Empowerment Scholarship Accounts | Education Savings Account (ESA) | $7,000 | Tuition, educational therapies, online ed, private tutoring, future educational expenses, etc | $10,446 |

| Lexie’s Law for Disabled and Displaced Students Tax Credit Scholarship Program | Tax-Credit Scholarship | $3,844 | Tuition | $10,446 |

| Low-Income Corporate Income Tax Credit Scholarship Program | Tax-Credit Scholarship | $3,834 | Tuition | $10,446 |

| Original Individual Income Tax Credit Scholarship Program | Tax-Credit Scholarship | $2,093 | Tuition | $10,446 |

Empowerment Scholarship Accounts

Invest in your child’s education through one of America’s most expansive Education Savings Account programs—all students in grades 1-12 qualify for Empowerment Scholarship Accounts in the state of Arizona. With no income requirements, no sliding funding scale, and no maximum enrollment rate, Arizona ESAs are hugely accessible. Over 75,000 students (and their families) are already benefiting from the program.

Applying for your child’s Empowerment Scholarship Account is also incredibly simple. Simply visit the Arizona Department of Education Website and click through to the application to get started. Arizona lawmakers focused on making the ESA system streamlined and easy to navigate—most applicants will only need to provide a copy of their child’s birth certificate and one document that provides proof of residency.

All Arizona students are awarded the same amount through the ESA program—90% of the per

-student allotment of public education funds. As of the 2023-2024 school year, the base ESA annual

amount is approximately $7,000 dollars. Students with special needs are eligible to receive even more

funding through the program, according to the services they require.

Families can use their ESA account to pay for private school tuition, as well as a number of other education-related expenses, including

- Textbooks

- Tutoring

- Online learning courses/fees

- School services (including

extracurriculars) - Insurance

- Uniforms

- Transportation expenses

- Computer hardware and tech (when used primarily for educational purposes)

- A wide variety of supplemental materials, for which documentation is not required

- Additional supplemental materials, with proper documentation

Take a look at the Arizona Department of Education’s full list of allowable ESA expenses to see how flexible and open-ended the program is. From graphing calculators and telescopes to sports equipment and art supplies, it’s easy to fund your child’s curiosity and passion for learning.

Note that families are not permitted to take part in Arizona’s Empowerment Scholarship Account program and a Tax-Credit Scholarship program at the same time, so be sure to explore all your options before deciding which is right for you and your child.

Tax-Credit Scholarships

Arizona taxpayers who donate to Certified Scholarship Granting Organizations can receive a 100% return on their donation in the form of a tax credit (capped at a max of $731/individual and $1,459/couple filing jointly). STOs use these funds to grant scholarships to Arizona students.

Eligibility for tax-credit scholarships varies according to the granting organization and the program that funds the scholarship. For example, scholarships funded by STOs through Arizona's Lexie’s Law help pay for private school for children with disabilities and those in foster care.

If you’re interested in exploring tax-credit scholarships for your child’s private school choice, check out the Arizona Department of Revenue’s lists of certified Arizona STOs here.

Save more on your child’s education with RaiseRight

Families earning with RaiseRight know it’s the easiest, most effective way to offset private school costs. While Arizona’s programs can help, they don't completely cover the average tuition fees. By maximizing your RaiseRight earnings, you could save over $1,000 a year to offset school costs and reduce financial strain.

*Based on average spend for a household family of 4